10-year Treasury yield dips to new 2016 lows further below 2%

.1562153928810.png?w=929&h=523&vtcrop=y)

By A Mystery Man Writer

The yield on the benchmark 10-year Treasury note fell to its lowest level since November 2016 on Wednesday, continuing its slide below 2%.

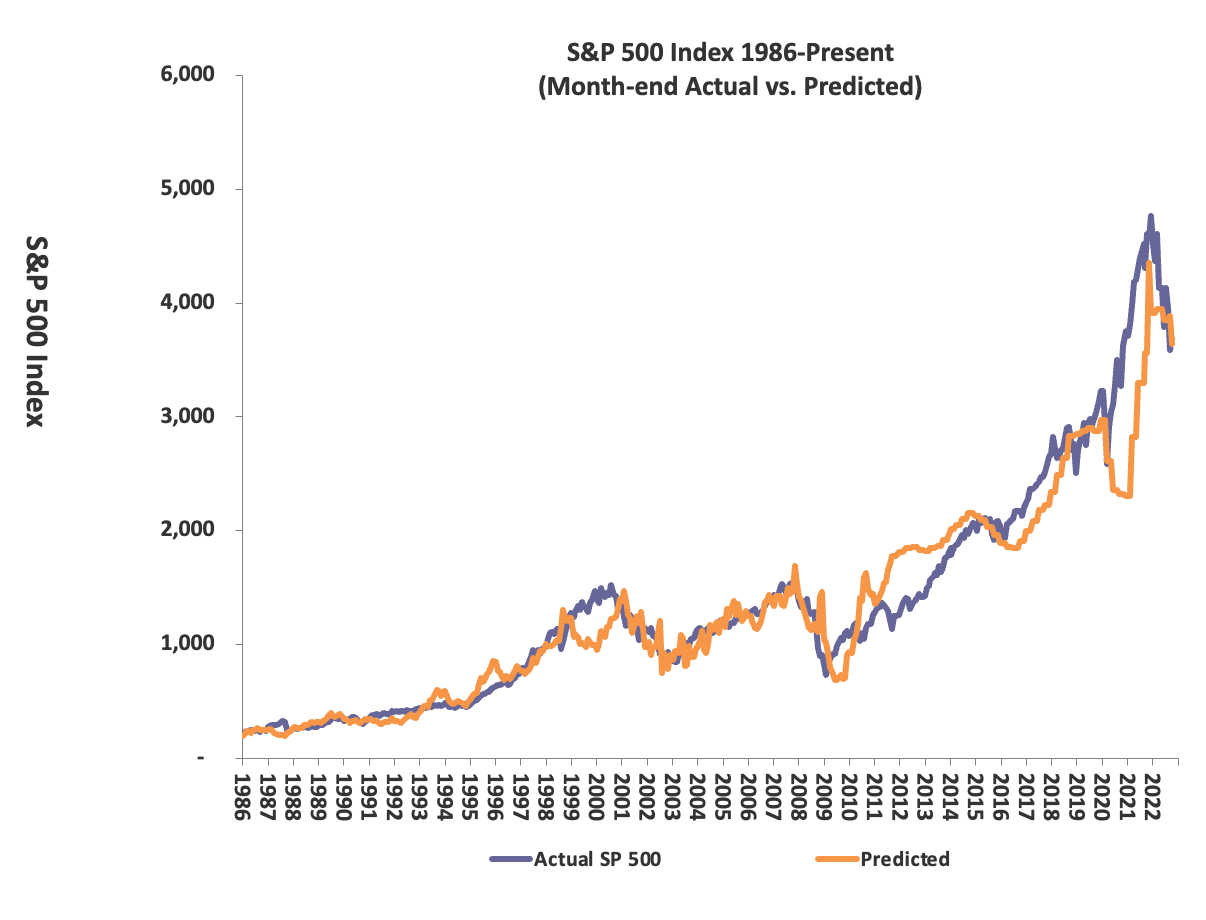

For the first time, (1) the S&P 500 earnings yield (medium risk), (2) corporate bonds (low risk), and (3) treasury bills (no risk) are all offering the same yield, 5.3% This means

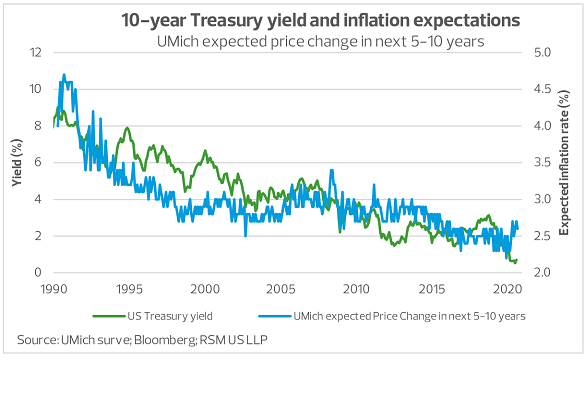

Forecasting interest rates in a post pandemic economy

10-Year Treasury Yield Falls Below 1.5% for First Time Since 2016 - Bloomberg

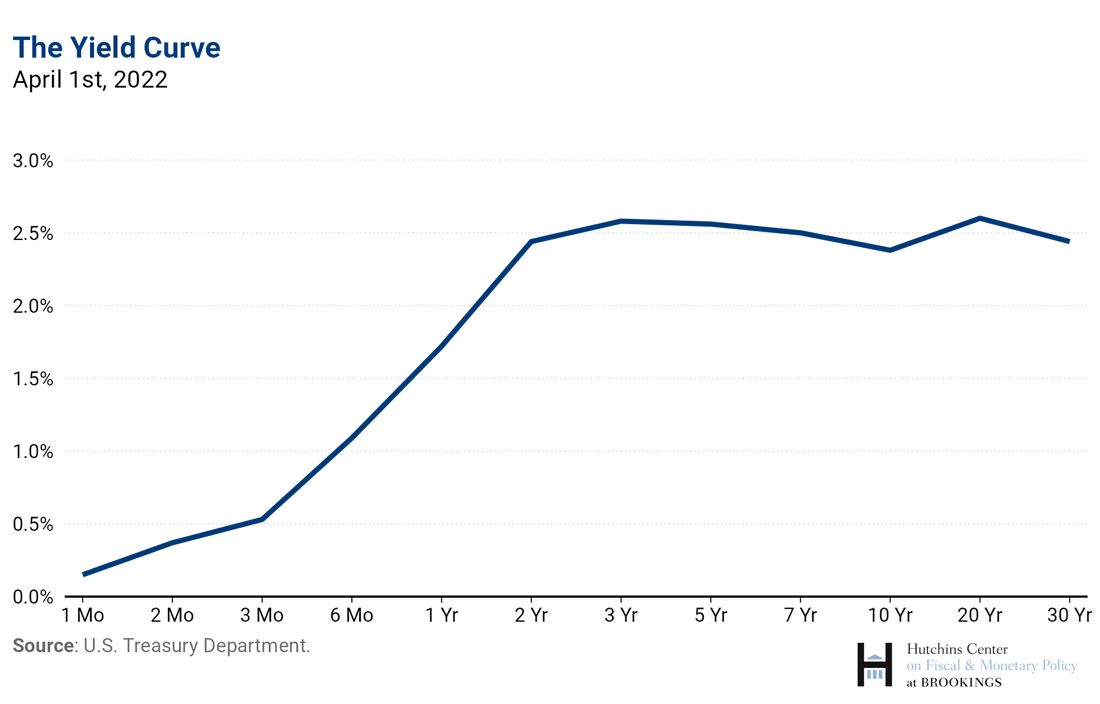

The Hutchins Center Explains: The yield curve - what it is, and why it matters

Negative Yields: The Final Frontier–Or A Brave New World?

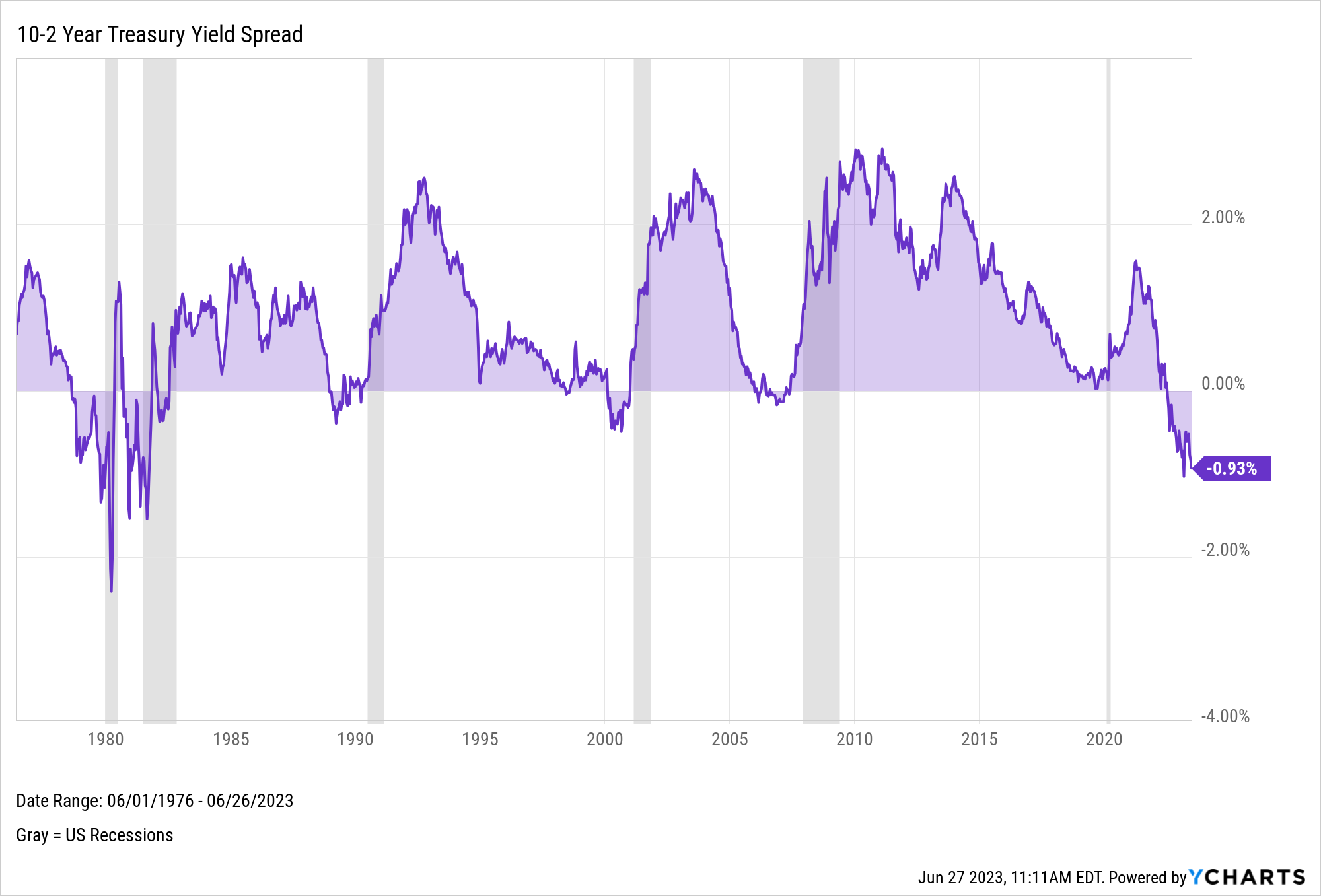

The Inverted Yield Curve: What It Means and How to Navigate It

SPY: How Sensitive Is S&P 500 To Bond Yields?

Patrick Slater on LinkedIn: #yieldcurve #steepening #valuation #riskmanagement #assetallocation…

Buying a burst bubble, bruised bond bulls wince

10-Year Treasury Yield Archives - the patient investor