Advances in Japanese Business and Economics: Property Price Index

By A Mystery Man Writer

Arrives by Mon, Apr 8 Buy Advances in Japanese Business and Economics: Property Price Index: Theory and Practice (Hardcover) at

This book answers the question of how exactly property price indexes should be constructed.

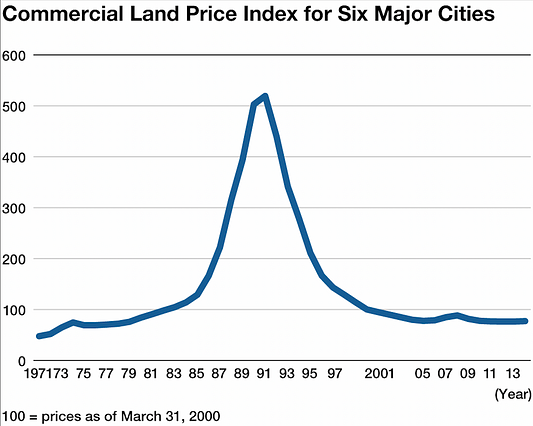

The formation and collapse of property bubbles has had a profound impact on the economic administration of many nations. The property price bubble that began around the mid-1980s in Japan has been called the 20th century's biggest bubble. In its aftermath, the country faced a period of long-term economic stagnation dubbed the lost decade. Sweden and the United States have also faced collapses of property bubbles in the 20th and early 21st centuries, respectively.

This book provides practical examples of how the theory of property price indexes can be applied to the issues of property as a non-homogenous good and a technological and environmental change.

Demographics and the Housing Market: Japan's Disappearing

Does Japan's Economy Prove That Neoliberalism Lost? – Foreign Policy

Stock market today: Live updates

How Japan got its swagger back

Japan's Economic Revival and the Road Ahead

Japan's Nikkei 225 index eclipses record high after 34 years

Japan stocks surge to 34-year high, but rally could slow amid

Three-Generation Mortgages? The Japanese Financial Crisis

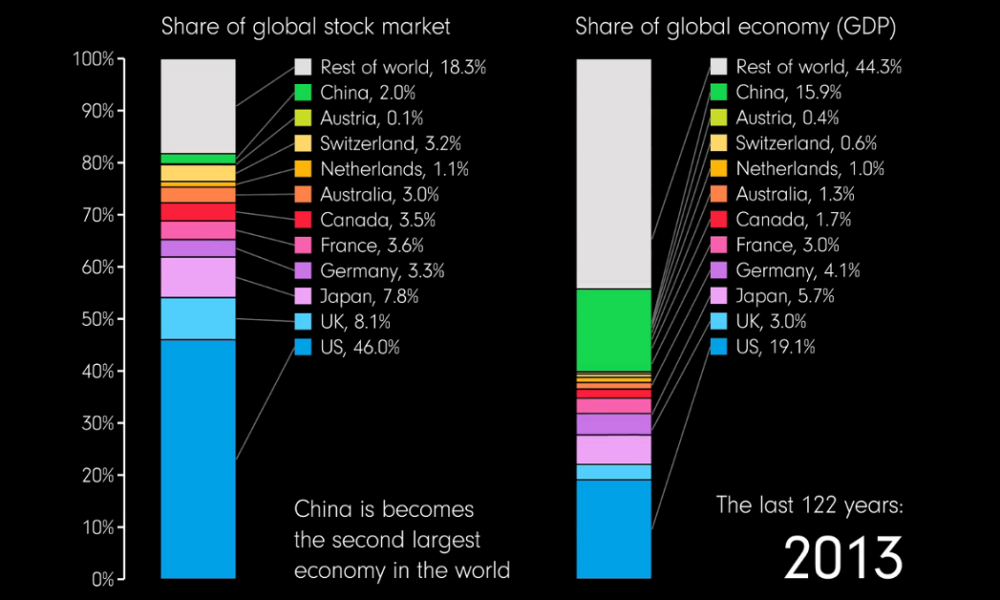

Animation: Stock Market vs. GDP Share, by Country (1900-2022)

- Orangetheory Fitness Macon - Can't put a price on your health and wellness especially 🍊💪🏽 #MoreLife

- Orangetheory Fitness Functional Training Hawthorn Track Your Workout Effort on the Otconnect Screens Using Your Otbeat Monitor.

- Orangetheory Fitness East Lansing - LAST WEEK TO UPGRADE BEFORE OCTOBER 1 PRICE INCREASE! 🍊There's no time like the present and we know you've been thinking about it! Let others know that

- ORANGETHEORY FITNESS CUPERTINO - 95 Reviews - 19409 Stevens Creek

- Orangetheory Fitness Macon - Can't put a price on your health and

- Alo Yoga Cropped Fresh Coverup Top in Black, Size: XS - ShopStyle

- Signature Logo Spacer Knit Mini Dress 802 Dahlia Pink

- Huggies - Huggies, Training Pants, Pull-Ups, Mickey/Toy Story (25 count), Shop

- Authentic Victoria's Secret Bra set 34A+XS, Women's Fashion, New

- The Adam Project's Walker Scobell cast as Percy Jackson for

:max_bytes(150000):strip_icc()/Percy-Jackson-b6c9f22a89b24d19bc628beedb5ae5bd.jpg)