Dependent Life Insurance – What is it, and Should You Have it?

By A Mystery Man Writer

Dependent Life insurance provides employees with a lump sum of money in the tragic event that one of their covered dependents passes away.

Dependent Life insurance provides employees with a lump sum of money in the tragic event that one of their covered dependents passes away, providing peace of mind for employees.

We help working Canadians obtain, understand, and access benefits.

How to Read and Understand Your Schedule of Benefits

Life Insurance

6 Key Features of Supplemental Group Term Life Insurance - GLG America

How to Read and Understand Your Schedule of Benefits

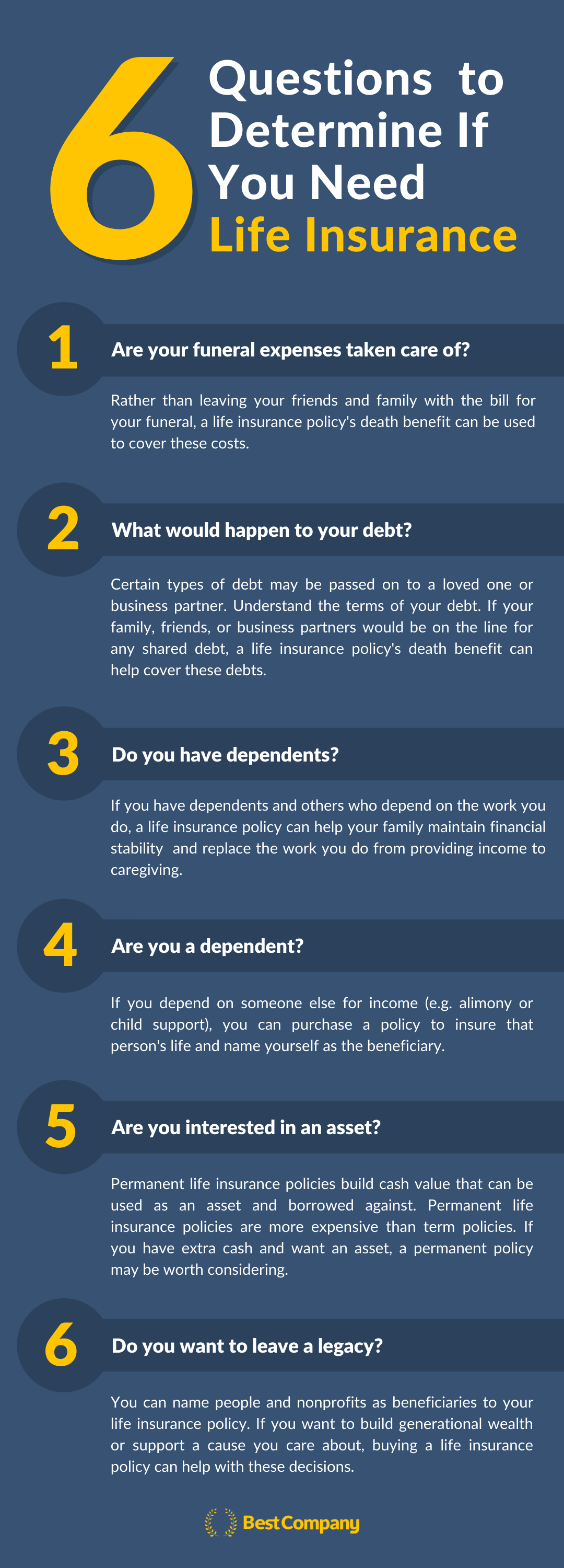

4 Things That Determine The Amount of Life Insurance Coverage You Need 📌 Your Outstanding Debts! 📌 The Amount Left on your Mortgage! 📌…

Do I Need Life Insurance?

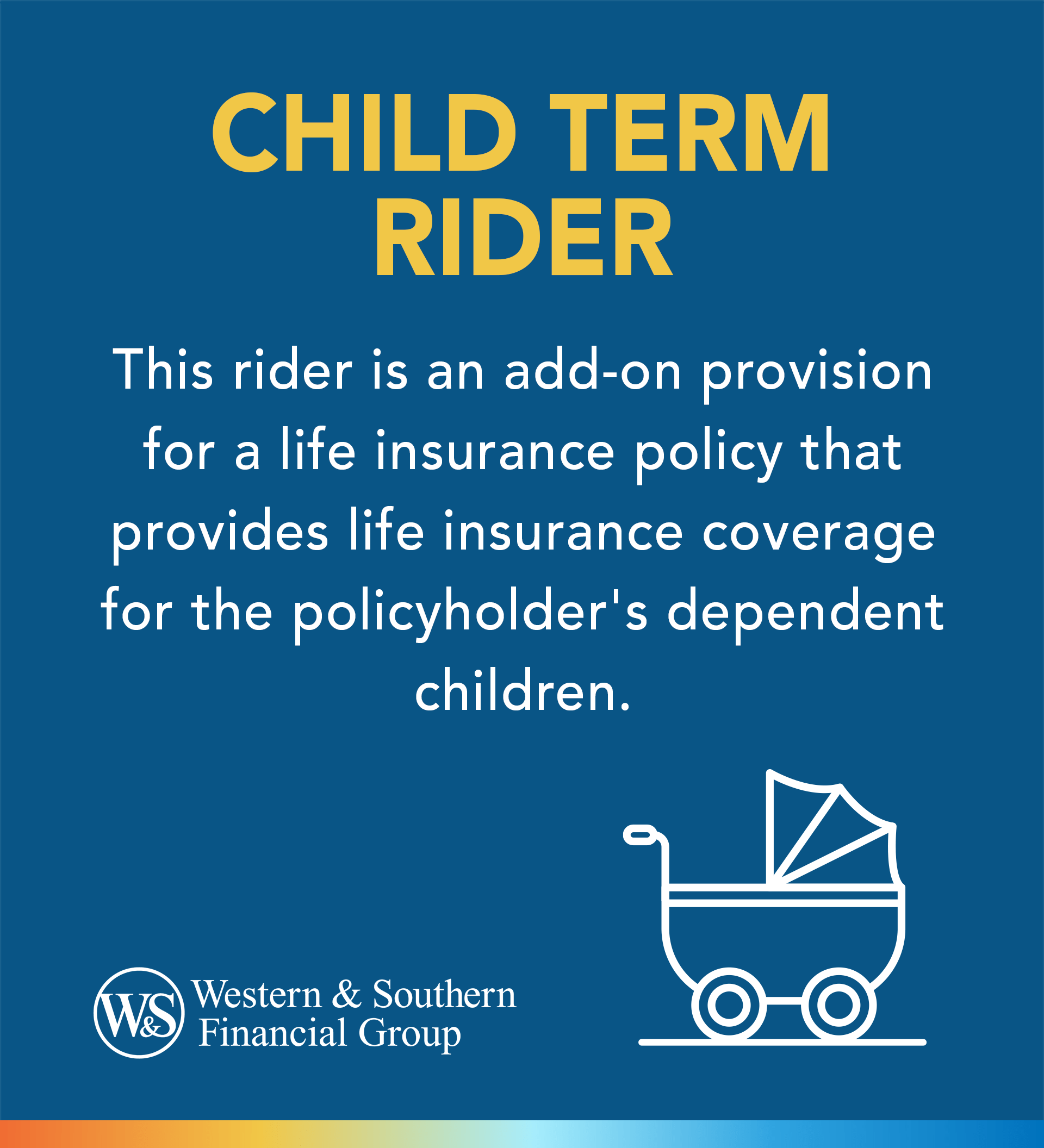

Understanding the Life Insurance Child Term Rider

What Is Dependent Life Insurance?

Suze Orman Quote: “If there is anyone dependent on your income – parents, children, relatives – you need

Suze Orman Quote: “If there is anyone dependent on your income – parents, children, relatives – you need

Dependent Life Insurance – What is it, and Should You Have it?

Associate Membership or Dependent Coverage: Determining What's Best For You — FEDmanager

What is Dependent Life Insurance & Who Qualifies? - ValuePenguin

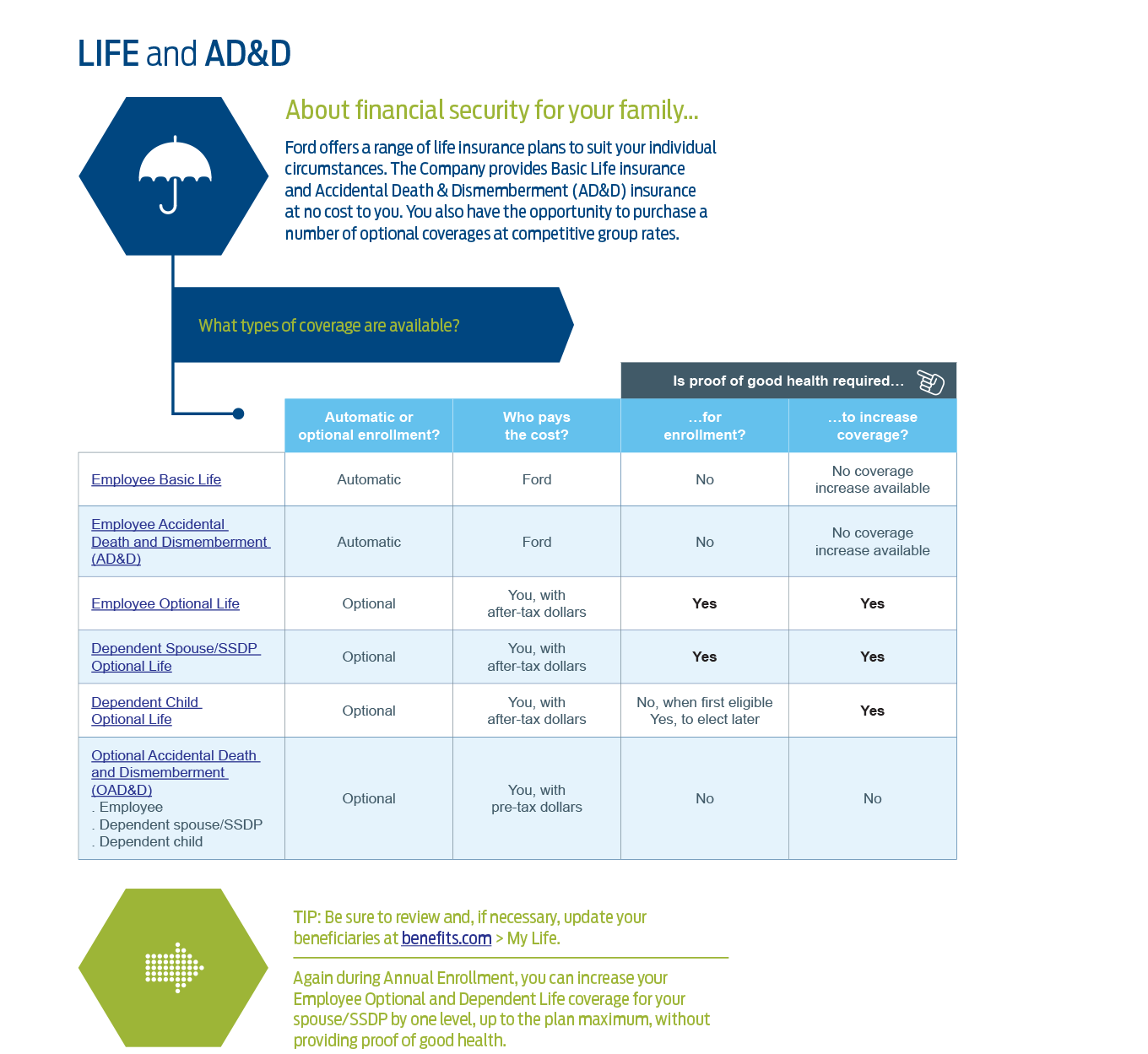

eGuide

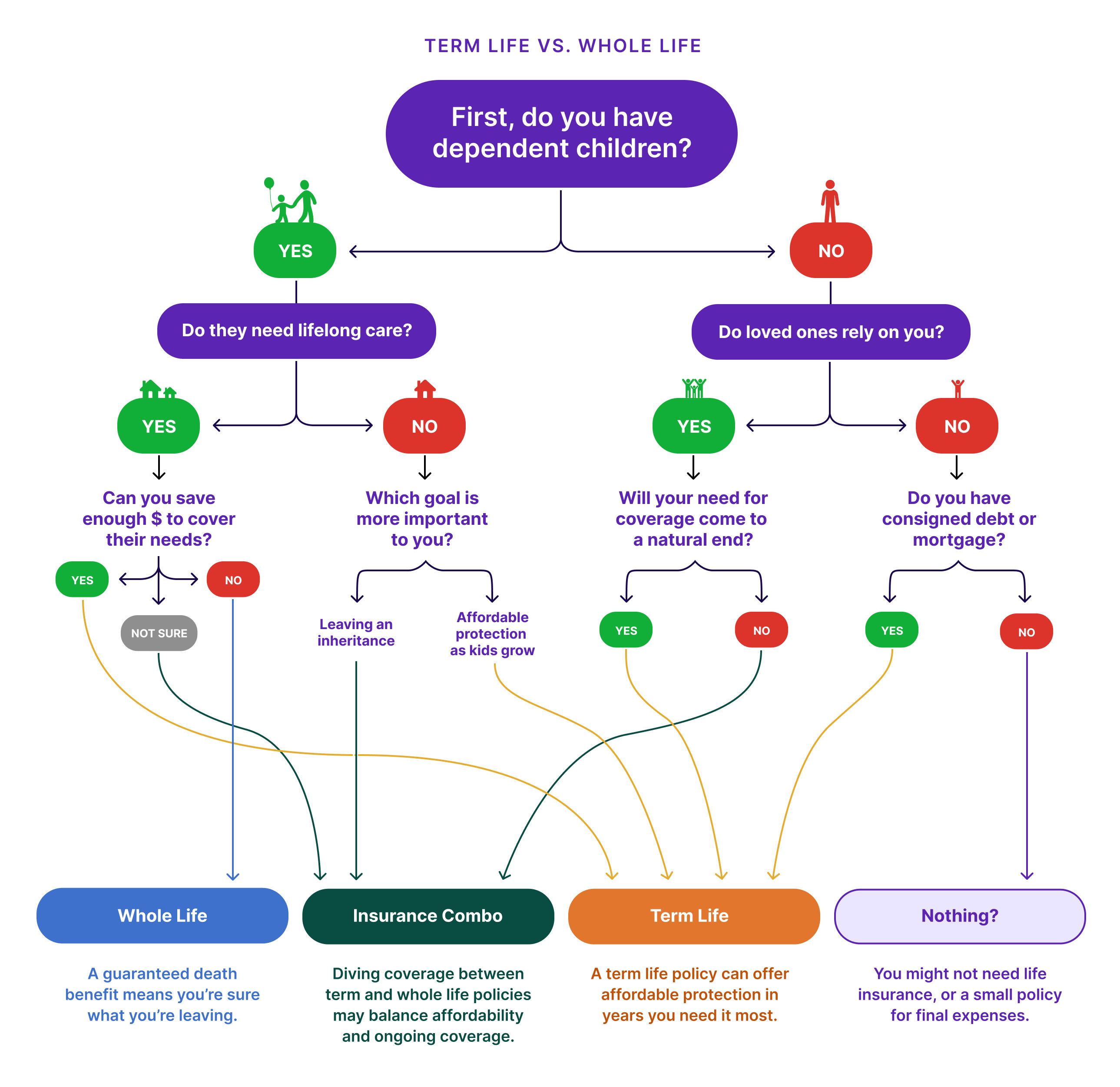

A Visual Guide to Choosing the Right Life Insurance for Your Family

- Warners® Blissful Benefits Super Soft Wireless Lightly Lined Comfort Bra RM1691W

- FINETOO Tummy Control Underwear for Women High Waisted Nylon Brief No Show Womens Bikini Seamless Panties 4pack S-XXXL Black at Women's Clothing store

- COMBINATION EMBROIDERED SHIRT - Pink marl

- DAISY DEE Women Everyday Non Padded Bra - Buy DAISY DEE Women

- Trendyol Collection Black Cotton Elastic Knitted Lingerie Set THMSS23CC00102 - Trendyol