What Is Reasonable Proof Under The Michigan No-Fault Act?

By A Mystery Man Writer

Since being enacted more than 40 years ago, the Michigan No-Fault Act has been rather difficult to understand and apply. But despite the Act’s overall complexities, there are some no-fault concepts that have retained their elegant simplicity — and one of these is “reasonable proof.” Under the Michigan No-Fault Act, an insurance company is required to pay personal protection insurance (PIP) claims within 30 days of receiving “reasonable proof of the fact and of the amount of loss sustained.” If an insurer fails to do this, it is liable for 12% annual penalty interest. Liability for penalty interest is strict

Can I Sue an Insurance Company for Denying My Claim? - FindLaw

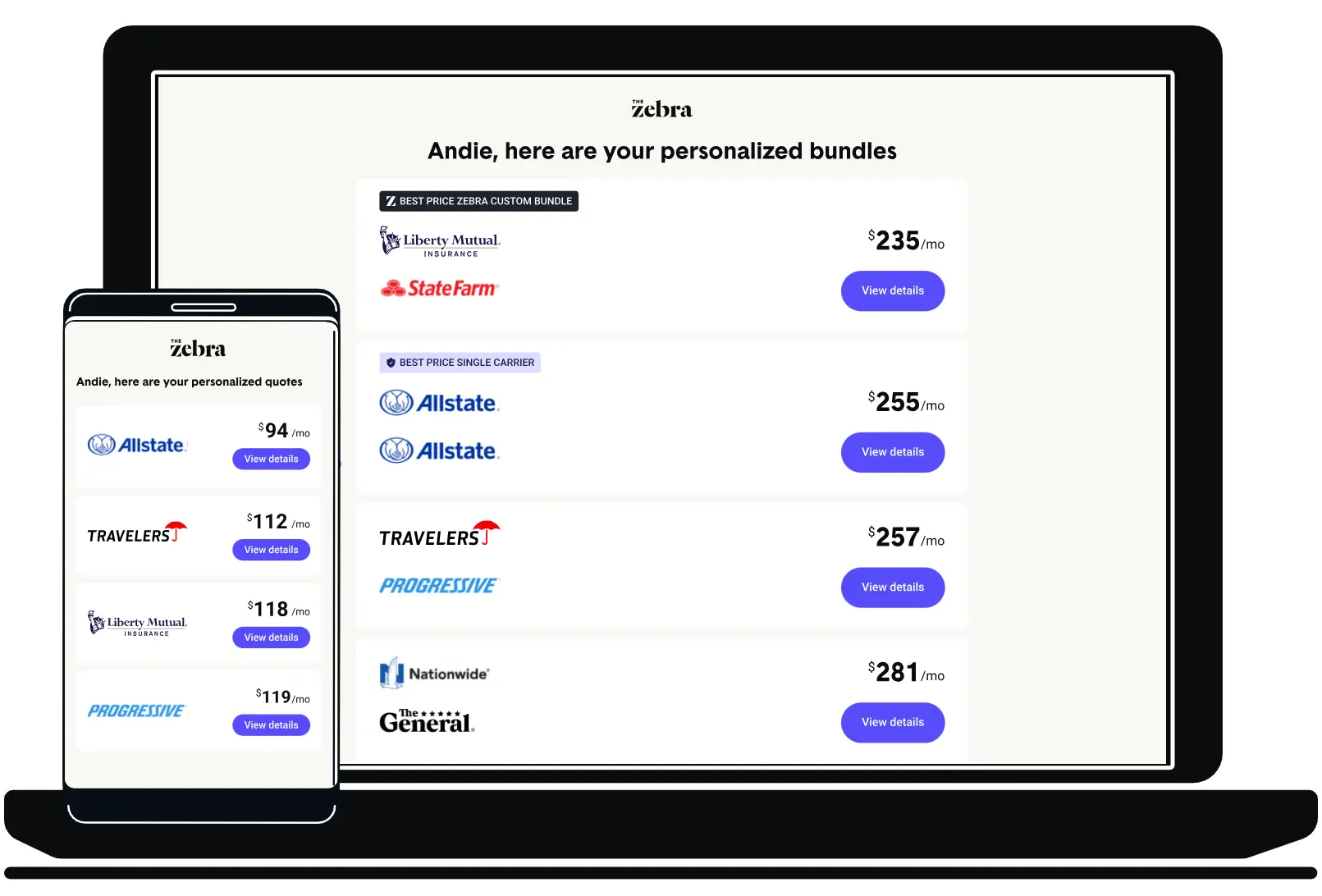

Cheap Car Insurance w/ No Down Payment — Free Quotes

Michigan No-Fault Insurance Law Overview

At-Fault vs No Fault Accident Claims in Your State - ValuePenguin

Michigan No-Fault Law, Oakland County

How the New No-Fault Law Affects The Michigan Catastrophic

CPAN -- The Coalition Protecting Auto No-Fault - Effective July 2

ACT/SAT for all: A cheap, effective way to narrow income gaps in

No-Fault Act

Car Insurance For Teenagers: Michigan Laws For Minors Explained

Michigan No-Fault Insurance Law Overview

What Happens In A No-Fault Accident, Who Pays?

Michigan Auto No-Fault Law FAQs

Explanation of Michigan No-Fault Law

Michigan No-Fault Act Broken Down - Michigan Auto Law

- Unders by Proof Women's Light Absorbency Period Underwear - Shop Pads & Liners at H-E-B

- Unders by Proof Women's Period Underwear Heavy Absorbency Leakproof Briefs

- How to Prove a Set of Functions is Closed Under Addition (Example

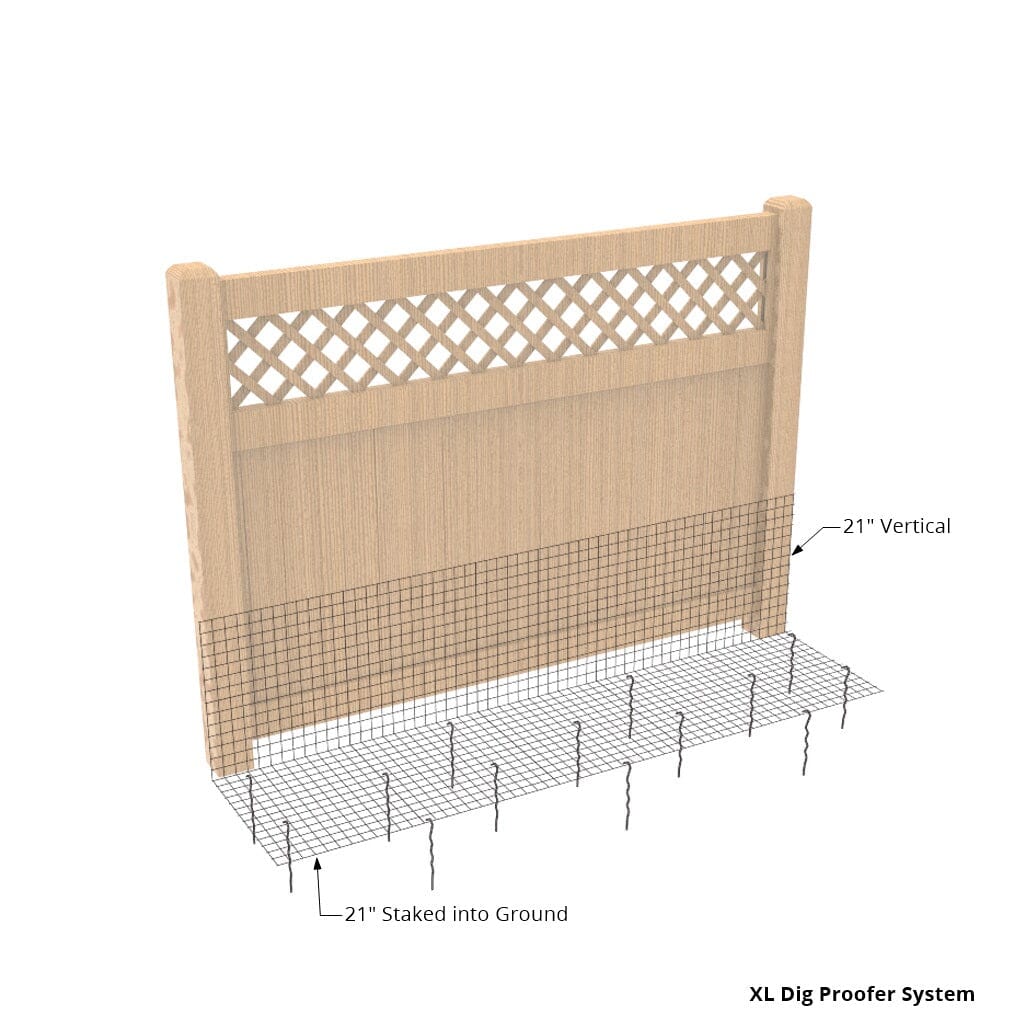

- No-Dig Fence For Dogs - Dig Proof Dog Fence Kit

- Free Stock Certificate Template & FAQs - Rocket Lawyer

- Cotton icon vector. fiber, fabric, flower, plant symbol 34922191 Vector Art at Vecteezy

- OEM Sports Bras Wholesale - Uga

- Sarees From Kiara Advani's Closet To Add In Your Wedding Trousseau

- Super Bowl weather history: Every time rain, wind, cold or snow complicated the big game

- Rio Carnival Parade Tickets 2025 (Mar 2024)