Low-Income Housing Tax Credits

By A Mystery Man Writer

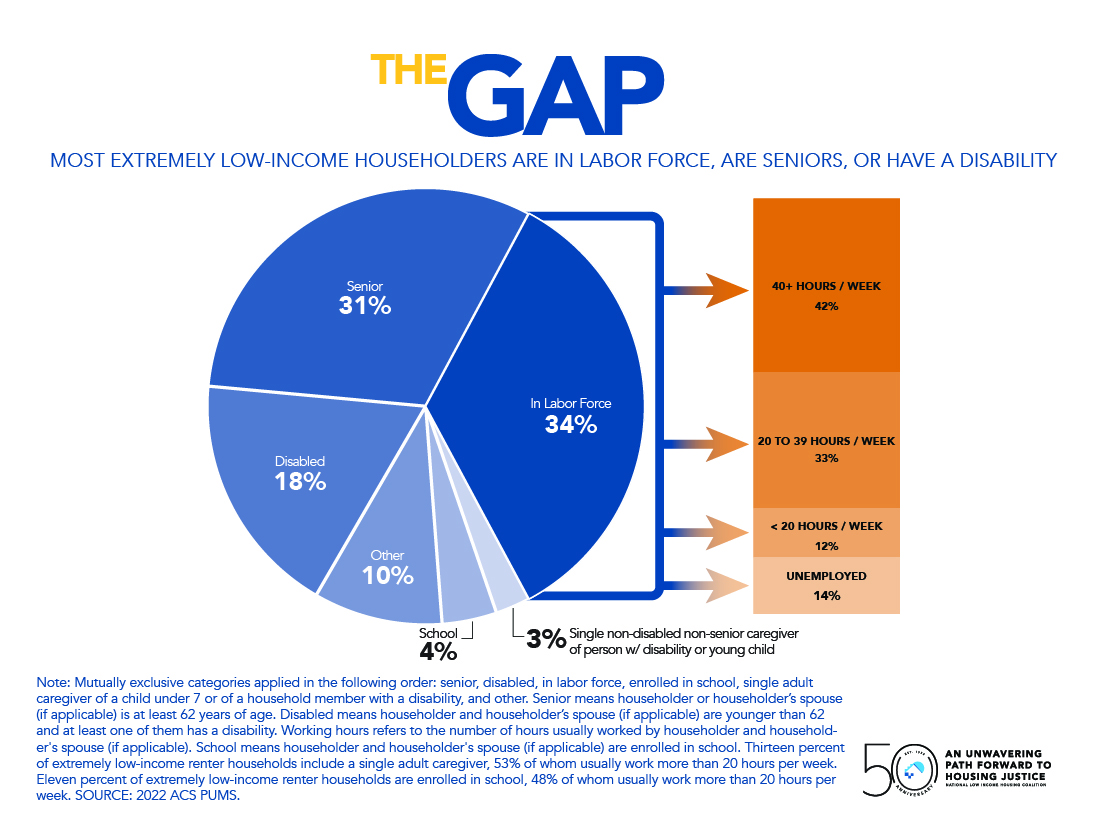

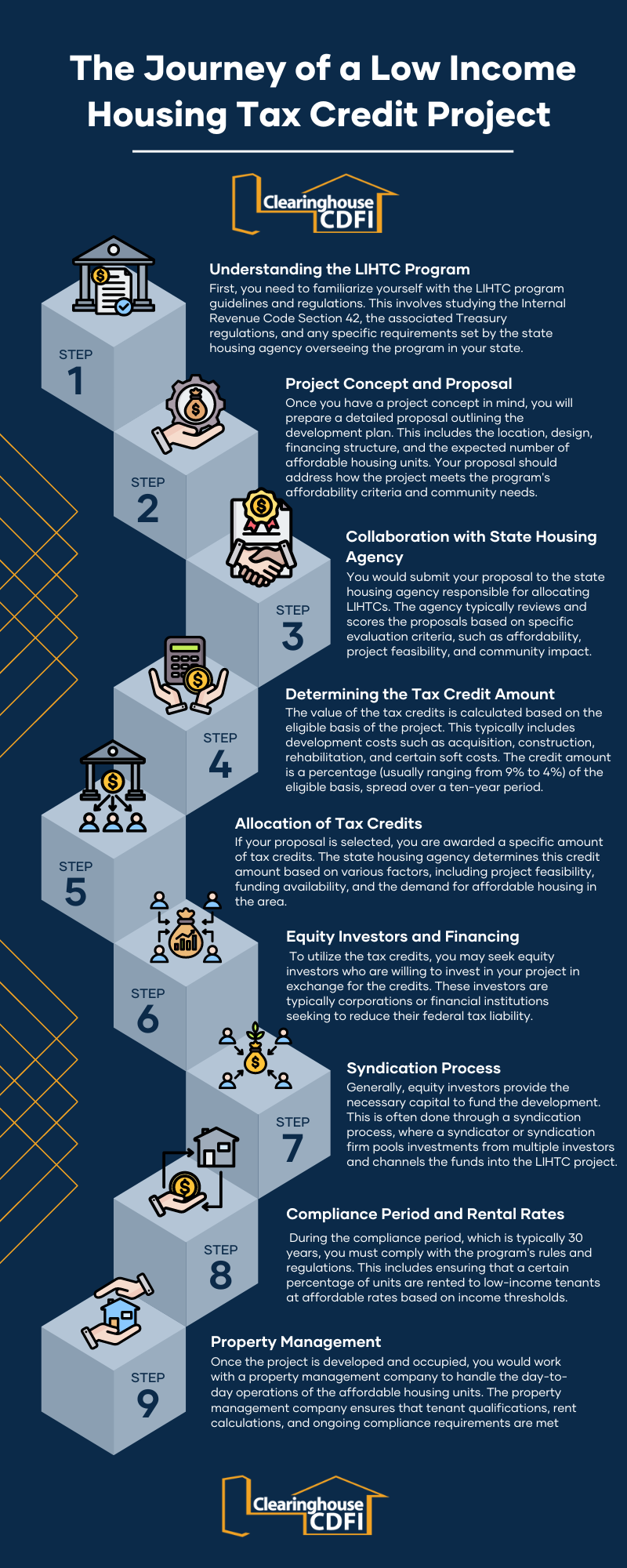

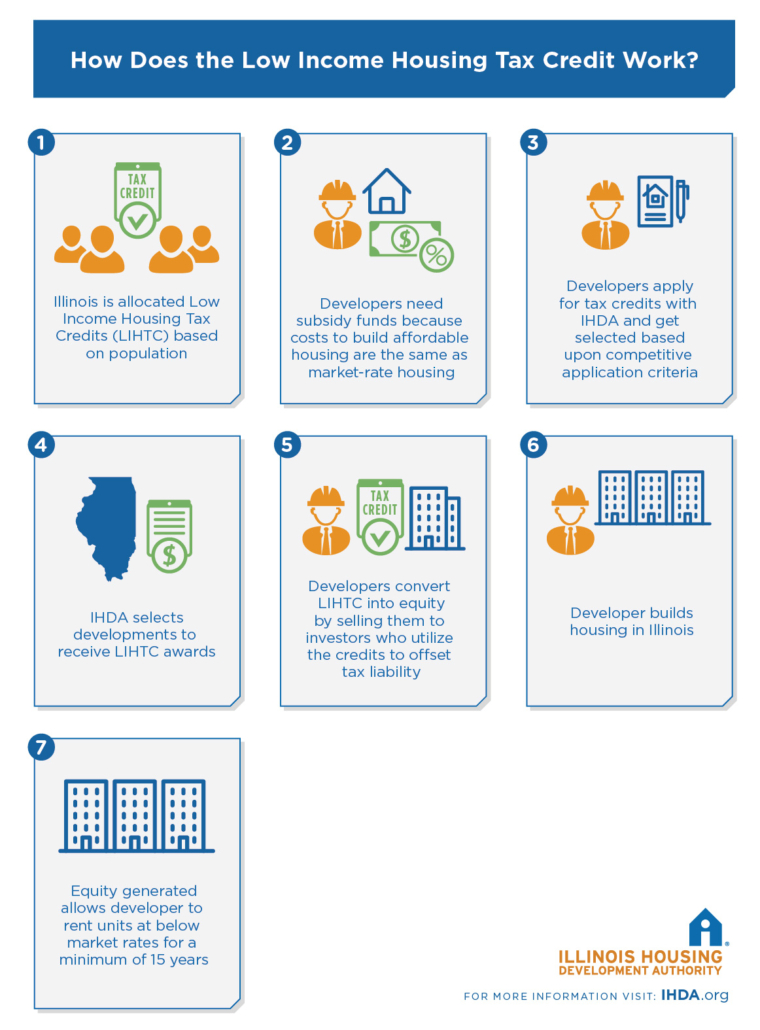

The Low Income Housing Tax Credit (LIHTC) program was created in 1986 and is the largest source of new affordable housing in the United States. There are about 2,000,000 tax credit units today and this number continues to grow by an estimated 100,000 annually. The program is administered by the Internal Revenue Service (IRS). The […]

The Effects of the Low-Income Housing Tax Credit (LIHTC) – NYU

Driving Community Impact with LIHTC

Agency involved in the LIHTC program.

Low-Income Housing Tax Credit (LIHTC) Overview

Who Really Pays for Affordable Housing? - Texas State Affordable

CDBG-DR Gap to Low Income Housing Tax Credits Program (LIHTC) - CDBG

Low Income Housing Tax Credit – IHDA

The Low-Income Housing Tax Credit: Expanding The U.S. Housing

.png)

What Are Low-Income Housing Tax Credits and Why Are They Important?

Why Invest in Low-Income Housing Tax Credit Projects? - Withum

Low-Income Housing Tax Credits Archives - Woda Cooper Companies, Inc.

HOW DO LOW-INCOME HOUSING TAX CREDIT PROJECTS TRIGGER REVITALIZATION IN SHRINKING CITIES ?

Low-income housing tax credits financial definition of low-income