Negative Correlation - FundsNet

By A Mystery Man Writer

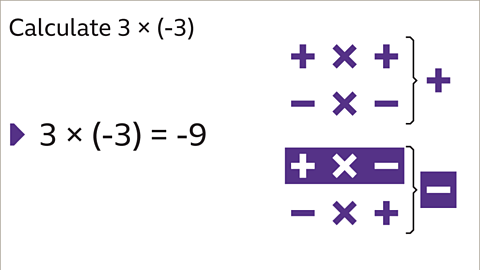

What is Negative Correlation? Negative correlation is a relationship between two variables where the variables have an inverse relationship. Basically, with negative correlation, as one variable increases, the other variable decreases. Negative correlation is often described by a correlation coefficient that is between 0 and -1. Two variables with a perfectly negative correlation would have View Article

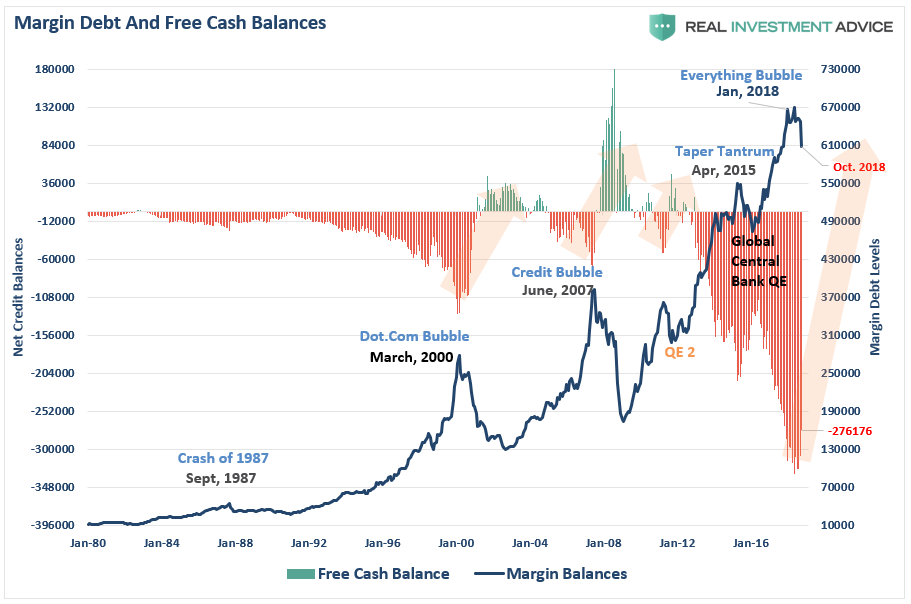

Misdiagnosing The Risk Of Margin Debt

U.S. Equity Mutual Funds: Net New Cash Flows (In billions of US

The performance of household-held mutual funds: Evidence from the

nf001_v1.jpg

Why Hedge? Benefits of CTA and Managed Futures Hedge Funds

Pension Reform, Financial Market Development, and Economic Growth

Monthly Credit Outlook: February 2023 Monthly Credit Outlook

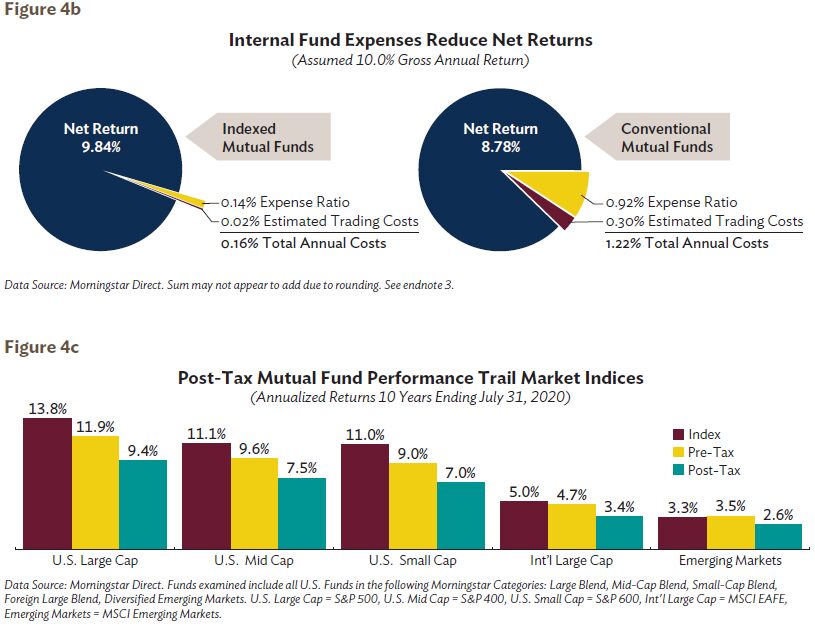

Challenge Conventional Wisdom

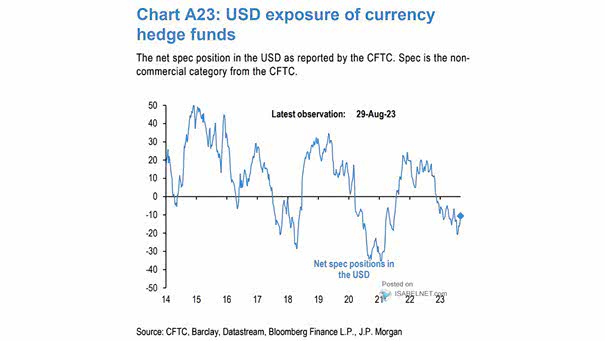

Search Results for “hedge fund exposure” – ISABELNET

Stefan Feuchtinger on LinkedIn: #eua #euets

The financial network channel of monetary policy transmission: an

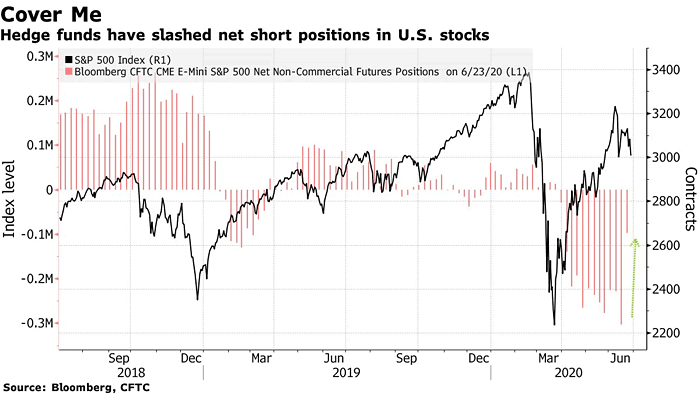

S&P 500 and Hedge Funds Net Short Positions – ISABELNET

Deep Learning Trading and Hedge Funds

Treasury Inflation-Protected Securities

Managing Nondeposit Liabilities AnalystPrep - FRM Part 2 Study Notes