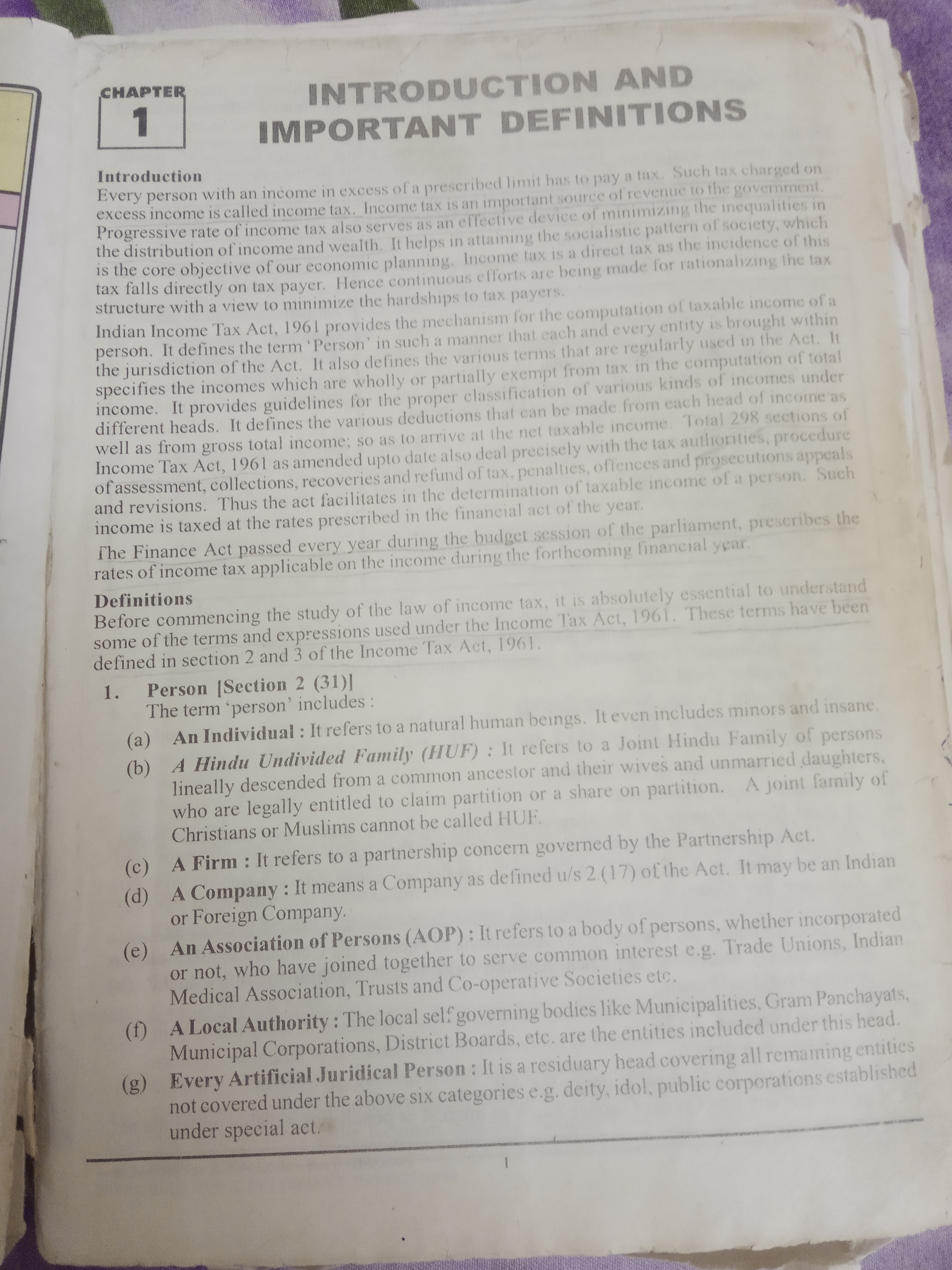

Who is a 'Person' under S. 2(31) of Income Tax Act in India

By A Mystery Man Writer

Find out what constitutes a 'person' under Section 2(31) of the Income Tax Act in India and what it means for tax purposes.

PERSON Section 2(31) of the Income Tax Act 1961. Basic concept of Income tax

Section 115bb - Betting Exchange India

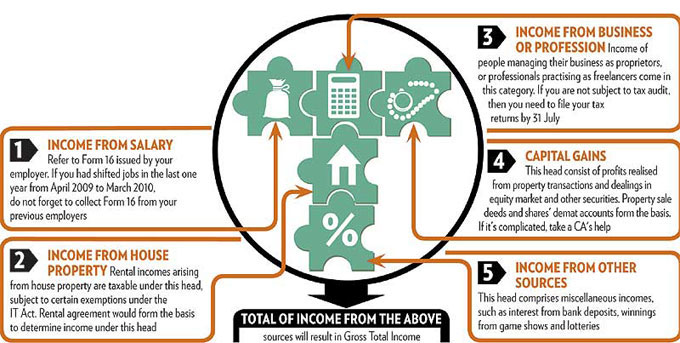

5 heads of income in the Indian Income Tax Act

Section 56(2)(X) of Income Tax Act - Tax Implication on Gifts

IMG_20211012_210355.jpg - Taxation Law - Notes - Teachmint

IMPORTANT DEFINITIONS INTHE INCOME-TAX ACT, ppt video online download

Person under income tax act, 1961

Income Tax and GST Compliance Calendar of March 2024

Income tax tasks which you need to complete before March 31 deadline - BusinessToday

INCOME EXEMPT FOR LOCAL AUTHORITY Archives - CA GuruJi

FAQs] Understanding Section 43B(h) of the Income-tax Act – Deductions for Payments to MSEs

Akshata Murty: Rishi Sunak's wife is a software heiress who's richer than royalty

Publication 17 (2023), Your Federal Income Tax

- Women's Clothes: Clearance, Old Navy

- Lynx Faux Leather Corset Top

- Heated Pants, USB 5V Heating Pants for Men Women Outdoor Winter Heating Trouser, 8 Heating Zone, Battery Not Included, Jeans, Pants & Trousers

- Andres Iniesta named new global brand ambassador for ASICS

- O fim da indiferença diante da exploração sexual infantil, Internacional

- White Kinsley Tube Top

- Sexy Couple Underwear Gay Men Boxer Shorts Faux Leather Wet Look Underpants Open Crotch Pouch Trunks Ass Free Gay Cueca1

- Adidas Indiana Hoosiers PE Warm Up Athletic Pants (M) GE2707

- LANBAOSI Long Sleeve Compression Shirts for Men 3-Pack Dri Fit Base Layer Workout Gym Athletic Summer Cooling Tshirts : : Clothing, Shoes

- Women's Leggings Sportswear Graphic Sportswear